additional net investment income tax 2021

But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. The investment income tax is a surtax of 38 in addition to the regular income tax that certain high-income taxpayers.

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

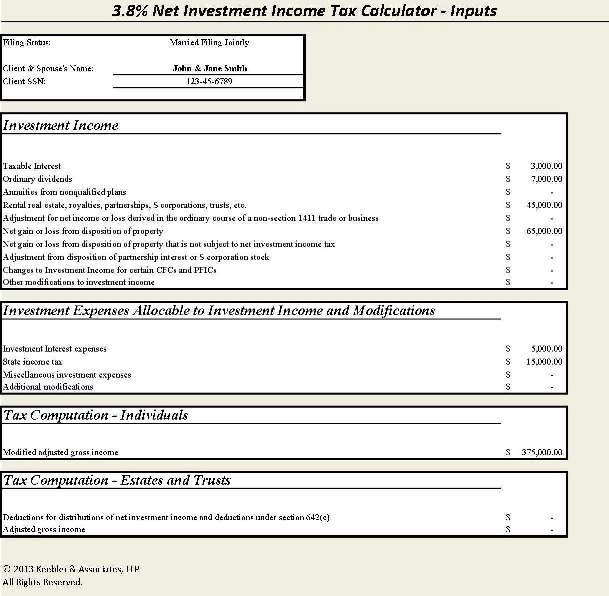

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

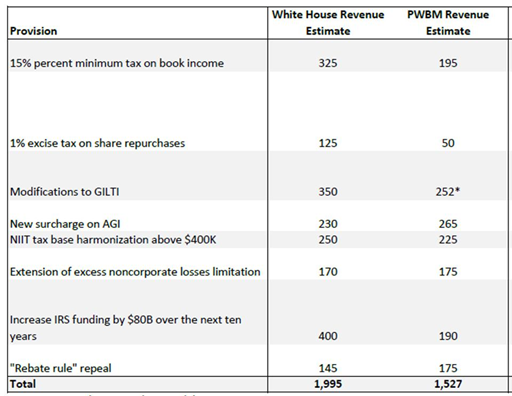

. You can explore various options for your unique situation using our new and. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross income exceeds the. The Joint Committee on Taxation estimated that the tax would generate 366 billion.

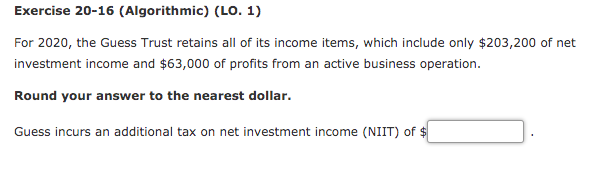

This tax is also known as the net investment income tax. A the undistributed net investment income or B the excess if any of. The firstthe additional Medicare taxis a.

Heres how that would look. In addition to the individual income tax high-income taxpayers face two taxes on certain types of income above specified thresholds. Because you must pay on the lesser amount you owe the 38 NIIT on the 5000 in net investment income.

Youll owe the 38 tax. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year over the. 5000 X 0038 190 You would owe.

Single or head of household 200000. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

April 28 2021 The 38 Net Investment Income Tax. Your additional tax would be 1140 038 x. The threshold amount for the 2021 tax year is 13050.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Taxpayers subject to the Net Investment. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Therefore the QFT has two beneficiary contracts with net investment income in excess of the threshold amount for the. April 28 2021 The 38 Net Investment Income Tax. The net investment income tax was included as part of that legislation to raise revenue.

10 with AGI up to 66000 in 2021 and 68000 in 2022. Today revenue from the net investment income tax goes to the US. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

To help fund the Affordable Care Act Obamacare an additional Medicare surtax is tacked on to your net investment income. The investment income tax is a surtax of 38 in addition to the regular income tax that certain.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Forbes Highlights Hit To Pass Throughs The S Corporation Association

A Guide To The Net Investment Income Tax Niit Smartasset

What Is Net Investment Income Tax Overview Of The 3 8 Tax

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

What Is Form 8960 Net Investment Income Tax Turbotax Tax Tips Videos

An Update On The Build Back Better Act Atkg Llp

Like Kind Exchanges Of Real Property Journal Of Accountancy

Tax Penalties For High Income Earners Financial Samurai

Net Investment Income Tax Niit Quick Guides Asena Advisors

Net Unrealized Appreciation Fpog Podcast Episode 2

An Overview Of Capital Gains Taxes Tax Foundation

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

Tax Updates From The Ways And Means Committee Withum Wealth

How To Calculate The Net Investment Income Properly

Zomma Group Tax News On April 28 2021 During President Biden S First Address To Congress He Announced Proposed Changes To The U S Tax Code To Fund The Proposed 1 8 Trillion American

Solved Exercise 20 16 Algorithmic Lo 1 For 2020 The Chegg Com